Here are the top considerations for dental offices when hiring a collection agency and why Kinum is your best choice. Serving hundreds of dentists nationwide.

We are fully aware of dental billing practices and steps to be followed for a quick insurance resolution.

Kinum has an average Google rating of 4.87 of 5.0 from over 2000 reviews.

1. Reputation Management:

- Patient Experience: Choose an agency that prioritizes a positive patient experience, even during the collection process. Aggressive or rude tactics can damage the dental office’s reputation.

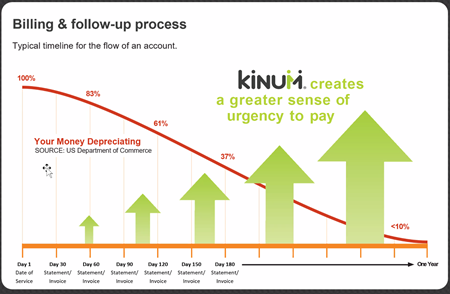

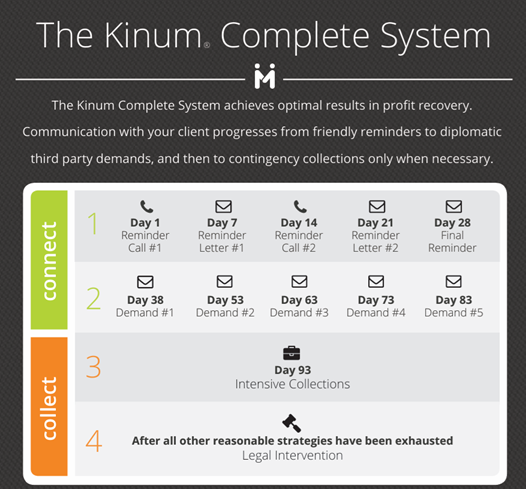

- Communication: The agency should communicate clearly and professionally with patients, explaining the debt and offering payment options. Collections should happen diplomatically, yet with the right amount of pressure.

- Online Reviews: Check online reviews and ratings to gauge the agency’s reputation among other dental offices and patients.

Need a dental collection agency? Contact Us

2. Fee Structure:

- Contingency Fee: The agency only gets paid a percentage of the debt they collect. This can be motivating for the agency, but the percentage might be high. (Sign up)

- Fixed Fee: The dental office pays a set low-fee, regardless of the amount collected. (Sign up)

3. Compliance with Regulations:

- FDCPA (Fair Debt Collection Practices Act): Ensure the agency strictly adheres to the FDCPA, which protects consumers from abusive debt collection practices. This includes not harassing patients, using deceptive tactics, or making false statements. They should also be GLBA compliant and offer a secure online client portal.

- HIPAA (Health Insurance Portability and Accountability Act): Since patient information is sensitive, the agency must be HIPAA compliant to safeguard patient privacy and confidentiality.

- State Regulations: Be aware of any specific state laws regarding debt collection practices that might be stricter than federal regulations.

4. Credit Reporting Laws:

- FCRA (Fair Credit Reporting Act): The agency should be familiar with the FCRA, which regulates how credit information is collected, used, and shared. This includes accurate reporting of debts and dispute resolution procedures. Dental debts under $500 and which are less than one year old, cannot be reported to the credit bureaus.

- Timing of Reporting: Understand when the agency will report unpaid debts to credit bureaus, as this can impact a patient’s credit score.

- Dispute Handling: Have a clear process in place for handling disputes if a patient claims a debt is incorrect.

| Contact us for collections: |

|

|